|

|

09-30-2022, 02:01 AM

|

|

|

|

Join Date: Jul 2017

Posts: 4,099

|

|

Quote:

Originally Posted by HyperMOA

Not that I totally disagree with much of what you are saying these comments made me laugh. Especially when they are written right next to each other.

You realize that $15 increase of minimum wage you applaud, caused the inflation you complain about in the next sentence. Well not the inflation of the last year obviously, but I’m pretty sure you know what I’m saying.

|

I didn’t applaud anything, actually. I stated what took place, aside from the third and last two paragraphs, perhaps.

As for realization and complaining… A bit of a personal disclosure. I had majored in Economics and Mathematics for nearly four years before quiting and switching to something else (like a complete dumb***, I should add - I had less then a semester left to graduate, probably with honours - and great regrets on my part, lol). While I am fairly certain I would fail or, at the very least, “wouldn’t do well” if I had to take most of the tests that I aced back in school because it was a while ago, my understanding of how basic things work is just fine, I am sure

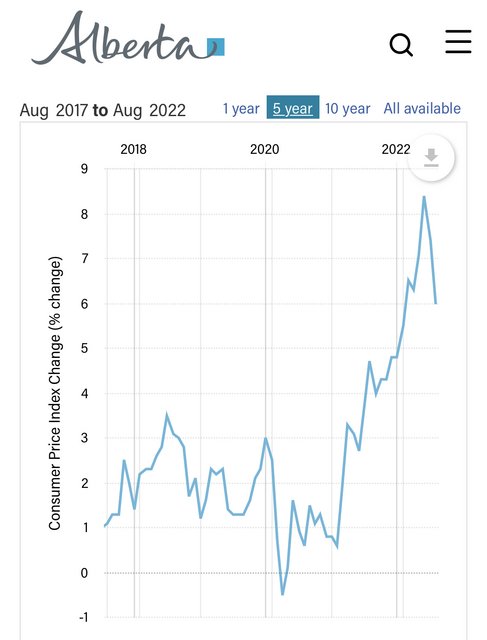

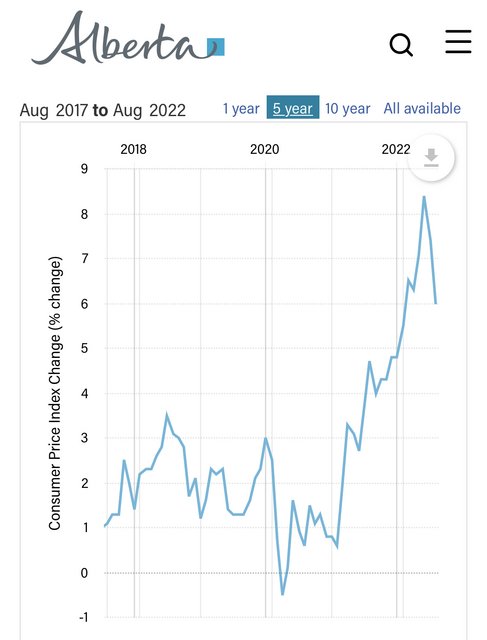

On the subject of inflation and minimum wage in Alberta in particular, have the prices been affected that much by the increase in minimum wage? Well, not really, or not nearly as much as people think they have. All of us here lived through it. Here is some visual data from the Government of Alberta (who took it from the Government of Canada) for the past five years:

While looking at the data, here is a bigger picture and one that explains why people were collecting 18% or whatever someone mentioned on their GIC’s back in the early to mid 80’s:

This is also somewhat of a preview of what we should expect in the near future.

Edit: This would probably be helpful too when looking at the graph above (which starts at 1980):

P. S. There is no “optimal” rate of 6 or whatever percent some people have mentioned.

|

09-30-2022, 06:29 AM

|

|

|

|

Join Date: Mar 2020

Posts: 1,097

|

|

Quote:

Originally Posted by HVA7mm

I won't lecture anyone regarding frivolous overspending and budgetary responsibility, we've all likely thrown money to the wind at one time or another. I'm not a "boomer" but a gen-Xer, and wasn't very financially sound for the first 30 years or so of my life. I likely also witnessed my parents struggle financially due to inflation and interest rates while growing up, but didn't really notice that much as we never had to worry about a meal on the table. There was never a lot of money, but we had something to eat. That being said, as a family we lived a much simpler life and certainly did without most of the creature comforts that my own family has become accustomed to. My dad would also say that his growing up was much more prosperous than that of his parents who grew up during the Great Depression.

Currently many young people are way more financially responsible than I was at their age, but stuff is really expensive now. I sincerely hope that the sting of inflation and rising interest rates will taper off and that the financial pain that people experience is short lived. I don't like seeing people go through tough times, and I would like to think that most others don't as well. Hang in there, humans are a pretty adaptable species and have powered through adversity since the beginning of time.

|

Some lessons are learned the hard way unfortunately. This is just one of those times. Nobody wants to see anyone hurting, sometimes it’s just lack of experience, youth, knowledge etc. This can be a learning experience for some if they let it. Unfettered spending both on a personal & government level has real world consequences.

|

09-30-2022, 08:41 AM

|

|

|

|

Join Date: Feb 2012

Location: Edmonton (shudder)

Posts: 4,814

|

|

Quote:

Originally Posted by fishnguy

I didn’t applaud anything, actually. I stated what took place, aside from the third and last two paragraphs, perhaps.

As for realization and complaining… A bit of a personal disclosure. I had majored in Economics and Mathematics for nearly four years before quiting and switching to something else (like a complete dumb***, I should add - I had less then a semester left to graduate, probably with honours - and great regrets on my part, lol). While I am fairly certain I would fail or, at the very least, “wouldn’t do well” if I had to take most of the tests that I aced back in school because it was a while ago, my understanding of how basic things work is just fine, I am sure

On the subject of inflation and minimum wage in Alberta in particular, have the prices been affected that much by the increase in minimum wage? Well, not really, or not nearly as much as people think they have. All of us here lived through it. Here is some visual data from the Government of Alberta (who took it from the Government of Canada) for the past five years:

While looking at the data, here is a bigger picture and one that explains why people were collecting 18% or whatever someone mentioned on their GIC’s back in the early to mid 80’s:

This is also somewhat of a preview of what we should expect in the near future.

Edit: This would probably be helpful too when looking at the graph above (which starts at 1980):

P. S. There is no “optimal” rate of 6 or whatever percent some people have mentioned. |

That’s weird I also was only 2 days away from being valedictorian of my economics class that I aced every test before switching to cheese appreciation. So I see the spike in 2018 that follows the increase of minimum wage in the 5 year chart you provided.

Sorry, I guess you didn’t applaud it but you mention how many of us were against it. I would bet you were in the acceptance camp. Thus the increase you agreed with not applauded would be a better term. Very different angles indeed.

Also, the inflation numbers are calculated federally not provincially, so how much sway would the CPI be influenced by Alberta’s rise in minimum wage?

Last edited by HyperMOA; 09-30-2022 at 08:54 AM.

|

09-30-2022, 01:56 PM

|

|

|

|

Join Date: Jul 2017

Posts: 4,099

|

|

^ You can laugh. Laughing is good for you, they say.

I can laugh too a bit though. I asked “have the prices been affected that much” and answered “not really or not nearly as much”. I didn’t say there was no “spike”. Being a cheese appreciation expert myself, I simply cannot allow myself to avoid pointing out another, larger spike, four years prior, another 2-3 years before that, then in 2007, and so on. Here is another look:

Was it the minimum wage? Was it the government spending? Relatively low interest rate? Was it something else? Here is a WTI crude price chart (adjusted for CPI), for example:

The short answer to the question asking if the CPI is calculated federally but not provincially is no. And how much would the WTI price be influenced by Alberta’s rise in minimum wage?

You could actually take a different, better approach, to your argument, but I am not going to derail any further. Is it a derail though? Who knows. Regardless, I am not here to discuss either my cheese appreciation expertise or the increase in minimum wage that happened 4 years ago.

|

09-30-2022, 02:10 PM

|

|

|

|

Join Date: Jun 2011

Posts: 3,722

|

|

Just hoping to learn something from the econ guys here. I get the wage price spiral theory but do rising wages cause inflation or are they a symptom? Is it any different this time around as compared to the 1970-80s do you think? And what is going on with the IS-LM model.? We have liquidity drying up at the same time as supply and demand are outta whack. And currency markets are starting to crumble a bit. Any predictions where you see rates a year out? I know it's hard to predict but do you think the Fed has broken things yet?

__________________

There are some who can live without wild things, and some who cannot. Aldo Leopold

|

09-30-2022, 11:19 PM

|

|

|

|

Join Date: May 2016

Location: Parkland County

Posts: 2,433

|

|

Quote:

Originally Posted by bdub

Just hoping to learn something from the econ guys here. I get the wage price spiral theory but do rising wages cause inflation or are they a symptom? Is it any different this time around as compared to the 1970-80s do you think? And what is going on with the IS-LM model.? We have liquidity drying up at the same time as supply and demand are outta whack. And currency markets are starting to crumble a bit. Any predictions where you see rates a year out? I know it's hard to predict but do you think the Fed has broken things yet?

|

Things to consider: Across the board wage increases are typically reflective of a labour shortage in one way or another, usually caused by overheating economic growth (but not always). Wages otherwise do not magically raise on their own as employers do not want to pay their workers more than they have to, so they’re largely set by the labour market (inclusive of small CoL increases from natural 1-2% inflation). Think of Fort McMurray during the boom years—wages for everyone from oil sands equipment operators to Tim Horton’s employees saw substantial wage growth because that’s what they had to pay to get workers into those jobs. This does cause the price of goods and services, housing, etc to raise, but it also doesn’t necessarily mean that the wage increase was the reason for that upward pressure, and that those same shortages can extend into housing, goods and services, etc.

However, there are a lot of key differences between that wage price spiral theory and the inflation we’re seeing here. Consumers do not lose as much purchasing power, the money supply stays roughly the same, and typically it does not include any stagflationary effects. Further, wage price spiral theory is more often on a more micro scale. Meanwhile, what we’re seeing is the direct consequences of rampant quantitative easing by central banks around the globe trying to keep their respective economies from collapsing during the pandemic. The money supply has increased substantially and consumer purchasing power is being eroded everywhere.

Governments are using wage increases as a red herring here. Wage increases certainly did not cause the inflation we’re seeing here, nor are they even a symptom. Instead, governments are trying to shift blame on wage increases to take the heat off of their short sighted economic management.

Rates will only continue to increase. Nobody knows where they will end but the recession is inevitable (and already here).

__________________

Bet the best when you know you got 'em.

|

10-01-2022, 01:23 AM

|

|

|

|

Join Date: Feb 2012

Location: Edmonton (shudder)

Posts: 4,814

|

|

Quote:

Originally Posted by jstubbs

Things to consider: Across the board wage increases are typically reflective of a labour shortage in one way or another, usually caused by overheating economic growth (but not always). Wages otherwise do not magically raise on their own as employers do not want to pay their workers more than they have to, so they’re largely set by the labour market (inclusive of small CoL increases from natural 1-2% inflation). Think of Fort McMurray during the boom years—wages for everyone from oil sands equipment operators to Tim Horton’s employees saw substantial wage growth because that’s what they had to pay to get workers into those jobs. This does cause the price of goods and services, housing, etc to raise, but it also doesn’t necessarily mean that the wage increase was the reason for that upward pressure, and that those same shortages can extend into housing, goods and services, etc.

However, there are a lot of key differences between that wage price spiral theory and the inflation we’re seeing here. Consumers do not lose as much purchasing power, the money supply stays roughly the same, and typically it does not include any stagflationary effects. Further, wage price spiral theory is more often on a more micro scale. Meanwhile, what we’re seeing is the direct consequences of rampant quantitative easing by central banks around the globe trying to keep their respective economies from collapsing during the pandemic. The money supply has increased substantially and consumer purchasing power is being eroded everywhere.

Governments are using wage increases as a red herring here. Wage increases certainly did not cause the inflation we’re seeing here, nor are they even a symptom. Instead, governments are trying to shift blame on wage increases to take the heat off of their short sighted economic management.

Rates will only continue to increase. Nobody knows where they will end but the recession is inevitable (and already here).

|

Yes, which is why Tiff Maclin was raising interest rates and he was begging employers not to give employees raises. He doesn’t need his interest rates eroded by increased wages.

The inflation was not caused by rapidly rising wages, in this scenario. A lot of ridiculous spending is definitely at the centre of the problem. A lot of our inflation is also caused by the broken supply chains we are seeing globally. That isn’t necessarily the fault of any one government, but our own demand for cheaper and cheaper products, that in turn reduce inflation. Boy she is a vicious cycle.

Giving mass wage increases just increase the number of dollars chasing fewer goods.

|

10-01-2022, 11:06 AM

|

|

|

|

Join Date: Oct 2007

Posts: 2,361

|

|

Quote:

Originally Posted by bdub

Just hoping to learn something from the econ guys here. I get the wage price spiral theory but do rising wages cause inflation or are they a symptom? Is it any different this time around as compared to the 1970-80s do you think? And what is going on with the IS-LM model.? We have liquidity drying up at the same time as supply and demand are outta whack. And currency markets are starting to crumble a bit. Any predictions where you see rates a year out? I know it's hard to predict but do you think the Fed has broken things yet?

|

In the end it's not just the fed that has broken things. People are pushing hard to do less work (less productivity) for more money thinking that will ultimately make their lives better. At the same time we are affecting the supply side by putting in place things like green rules and sanctions. While those may be viewed as honorable moves and necessary, they still negatively affect the supply side and hurt affordability for everyone. Pile on enormous amounts of fiat at a time of stagnant or declining productivity and you get big time inflation and less affordability. Monetary policy and its failings are just a reflection of a bigger problem. For years we've tried to use monetary means to fix/cover over far more systemic issues and the chickens are coming home to roost. It was never a sustainable model.

|

10-01-2022, 04:30 PM

|

|

|

|

Join Date: May 2016

Location: Parkland County

Posts: 2,433

|

|

https://www.theglobeandmail.com/inve...-young-adults/

Oh look, another article highlighting this issue.

In September, Mike Franzgrote, 69, said goodbye to his 37-year-old son, his daughter-in law and their newborn baby after the couple purchased their first home in Moncton. The three adults had shared Mr. Franzgrote’s bungalow in Bradford, Ont., for three years, while the couple worked and saved up for a down payment after relocating from Vietnam, he said.

Before that, Mr. Franzgrote had his daughter, now 35, living with him on and off for extended periods after graduation to help her pay off her student loans and, later, save for a home.

It’s a starkly different timeline from the one that marked Mr. Franzgrote’s own transition into adulthood. After getting married at 19, he moved from Maxville, Ont. to Toronto at 20. At the age of 22, he’d bought his first home for what was then $47,000, orjust less than $250,000 in today’s dollars.

Just stop buying coffee every morning! That’s why young people can’t afford homes!

__________________

Bet the best when you know you got 'em.

|

10-01-2022, 04:32 PM

|

|

Banned

|

|

Join Date: May 2021

Posts: 358

|

|

Quote:

Originally Posted by jstubbs

https://www.theglobeandmail.com/inve...-young-adults/

Oh look, another article highlighting this issue.

In September, Mike Franzgrote, 69, said goodbye to his 37-year-old son, his daughter-in law and their newborn baby after the couple purchased their first home in Moncton. The three adults had shared Mr. Franzgrote’s bungalow in Bradford, Ont., for three years, while the couple worked and saved up for a down payment after relocating from Vietnam, he said.

Before that, Mr. Franzgrote had his daughter, now 35, living with him on and off for extended periods after graduation to help her pay off her student loans and, later, save for a home.

It’s a starkly different timeline from the one that marked Mr. Franzgrote’s own transition into adulthood. After getting married at 19, he moved from Maxville, Ont. to Toronto at 20. At the age of 22, he’d bought his first home for what was then $47,000, orjust less than $250,000 in today’s dollars.

Just stop buying coffee every morning! That’s why young people can’t afford homes!

|

If you and your GF/Wife both stopped drinking coffee in the AM, you could be a Millionaire

|

10-01-2022, 05:01 PM

|

|

|

|

Join Date: Mar 2020

Posts: 1,097

|

|

Quote:

Originally Posted by jstubbs

https://www.theglobeandmail.com/inve...-young-adults/

Oh look, another article highlighting this issue.

In September, Mike Franzgrote, 69, said goodbye to his 37-year-old son, his daughter-in law and their newborn baby after the couple purchased their first home in Moncton. The three adults had shared Mr. Franzgrote’s bungalow in Bradford, Ont., for three years, while the couple worked and saved up for a down payment after relocating from Vietnam, he said.

Before that, Mr. Franzgrote had his daughter, now 35, living with him on and off for extended periods after graduation to help her pay off her student loans and, later, save for a home.

It’s a starkly different timeline from the one that marked Mr. Franzgrote’s own transition into adulthood. After getting married at 19, he moved from Maxville, Ont. to Toronto at 20. At the age of 22, he’d bought his first home for what was then $47,000, orjust less than $250,000 in today’s dollars.

Just stop buying coffee every morning! That’s why young people can’t afford homes!

|

I’m sure #Justinflation is helping.

|

10-01-2022, 06:21 PM

|

|

Banned

|

|

Join Date: Mar 2009

Posts: 5,700

|

|

Quote:

Originally Posted by The Elkster

In the end it's not just the fed that has broken things. People are pushing hard to do less work (less productivity) for more money thinking that will ultimately make their lives better. At the same time we are affecting the supply side by putting in place things like green rules and sanctions. While those may be viewed as honorable moves and necessary, they still negatively affect the supply side and hurt affordability for everyone. Pile on enormous amounts of fiat at a time of stagnant or declining productivity and you get big time inflation and less affordability. Monetary policy and its failings are just a reflection of a bigger problem. For years we've tried to use monetary means to fix/cover over far more systemic issues and the chickens are coming home to roost. It was never a sustainable model.

|

This right here 👍

|

10-02-2022, 10:12 AM

|

|

|

|

Join Date: Jun 2011

Posts: 3,722

|

|

Thanks for all the replies on productivity.

So now what happens with rising rates and the drain on liquidity. The Feds are now sucking money out of the system shifting the LM curve up at the same time that governments are going to be forced to raise taxes and cut spending, investment is decreasing due to interest rates and a decline in output, and the marginal propensity to consume is also getting hammered. The only thing benefitting from the decline in the CAD$ is net exports, but thanks to government policy, we are not taking full advantage of that. We now have governments around the world jumping into currency markets to defend their currencies, selling USD$ and buying their own ie. China just recently jumping on the band wagon with Japan, UK, Euro Zone so pretty much every major economy in the same boat.

I guess the question boils down to where do you see the US FED start their pivot on rates? Do you think they will continue tightening until they push the whole world into a deep downturn or will they back off soon? It sounds like at least another 75 bps before year end is baked in already, but past that?

__________________

There are some who can live without wild things, and some who cannot. Aldo Leopold

|

10-02-2022, 12:26 PM

|

|

|

|

Join Date: Aug 2009

Location: AB

Posts: 6,673

|

|

Quote:

Originally Posted by bdub

It sounds like at least another 75 bps before year end is baked in already, but past that?

|

Ive been reading 150 bps before years end and before 2023 is over it will be somewhere in the 6% range about double of what it is right now.

__________________

|

10-02-2022, 01:29 PM

|

|

|

|

Join Date: Jun 2011

Posts: 3,722

|

|

Quote:

Originally Posted by whitetail Junkie

Ive been reading 150 bps before years end and before 2023 is over it will be somewhere in the 6% range about double of what it is right now.

|

I can't imagine how bad 6% rates are gonna feel with all the debt out there and real wages not keeping up for the vast majority.

__________________

There are some who can live without wild things, and some who cannot. Aldo Leopold

|

10-02-2022, 01:36 PM

|

|

|

|

Join Date: Feb 2013

Location: Claresholm, AB

Posts: 796

|

|

Quote:

Originally Posted by bdub

I can't imagine how bad 6% rates are gonna feel with all the debt out there and real wages not keeping up for the vast majority.

|

Its going to hurt.

Many people who locked in a low rate when they moved during the pandemic are going to lose their houses if the rates are that high when they go to renew.

I'm just thankful I have a lot of wiggle room and didn't borrow even close to what the bank told me I could.

|

10-03-2022, 09:59 AM

|

|

|

|

Join Date: Sep 2012

Posts: 6,439

|

|

Guys here is my prediction, I do not believe we will get 18% like in the 1980's but I think 10-12% is on the horizon. Years of cheap Money$$ are over.

|

10-05-2022, 08:34 AM

|

|

|

|

Join Date: Dec 2008

Location: At the lake

Posts: 2,614

|

|

Quote:

Originally Posted by Big Grey Wolf

Guys here is my prediction, I do not believe we will get 18% like in the 1980's but I think 10-12% is on the horizon. Years of cheap Money$$ are over.  |

If your prediction comes true, there will be a lot an awful lot of unhappy campers considering a $500K mortgage would cost the owner $5100/month at 12%.

|

10-05-2022, 08:40 AM

|

|

|

|

Join Date: Jan 2016

Posts: 29

|

|

That is the level of pain that is required to bring our housing back to normal prices.

|

10-05-2022, 08:50 AM

|

|

|

|

Join Date: Dec 2008

Location: At the lake

Posts: 2,614

|

|

Quote:

Originally Posted by johnnymacrds

That is the level of pain that is required to bring our housing back to normal prices.

|

It definitely will do that, considering how many over extended themselves.

|

10-05-2022, 11:39 AM

|

|

|

|

Join Date: Sep 2012

Posts: 6,439

|

|

Most households will handle the 10-12% mtge rates, but may have to delay the new Quad, sled or boat purchase.

|

10-05-2022, 12:52 PM

|

|

|

|

Join Date: Apr 2009

Posts: 257

|

|

Quote:

Originally Posted by Big Grey Wolf

Most households will handle the 10-12% mtge rates, but may have to delay the new Quad, sled or boat purchase.

|

I dont think so. There are a lot of households out there that are a paycheck or two away from not having any money.

|

10-05-2022, 01:14 PM

|

|

|

|

Join Date: Jul 2010

Location: Whitecourt

Posts: 7,024

|

|

Quote:

Originally Posted by Big Grey Wolf

Most households will handle the 10-12% mtge rates, but may have to delay the new Quad, sled or boat purchase.

|

What will happen to renters in a situation like that? I assume rents will also increase to levels that most renters can't afford, or the owners will foreclose and kick them out.

Sent from my SM-G781W using Tapatalk

|

10-05-2022, 01:21 PM

|

|

Moderator

|

|

Join Date: Feb 2015

Posts: 8,096

|

|

For fun....

$400,000 mortgage, 25 year amortization, monthly payment at 3%: $1,892.98

$400,000 mortgage, 25 year amortization, monthly payment at 6%: $2,559.23

$400,000 mortgage, 25 year amortization, monthly payment at 10%: $3,577.95

Difference: $666.25/month to $1,018.72 for a total spread of: $1,684.97.

If it goes to 6%, it will be uncomfortable for alot of people, but I doubt people are loosing their homes. Pull the kids out of minor hockey, maybe a few other things, and you've pretty much made up the difference. If it goes to 10% though, and people are now expected to come up with an additional $1,687.97/month, I expect people will loose their homes/market will be flooded as they try to recover some equity before the banks take them.

|

10-05-2022, 02:25 PM

|

|

|

|

Join Date: Apr 2009

Posts: 257

|

|

Quote:

Originally Posted by leeaspell

What will happen to renters in a situation like that? I assume rents will also increase to levels that most renters can't afford, or the owners will foreclose and kick them out.

Sent from my SM-G781W using Tapatalk

|

Im questioning this as well.

I have 3 properties with mortgages on them. Locked in rates 2 years ago so have 3 more to go. But if rates hit double digits im either forced to hike rent significantly or sell the house. Does a guy get out now?

|

10-05-2022, 03:17 PM

|

|

|

|

Join Date: May 2010

Location: edmonton

Posts: 3,920

|

|

Quote:

Originally Posted by SHEDHEAD

Im questioning this as well.

I have 3 properties with mortgages on them. Locked in rates 2 years ago so have 3 more to go. But if rates hit double digits im either forced to hike rent significantly or sell the house. Does a guy get out now?

|

Depending on location. in Edmonton I have seen more for sale sign and for rent sign on rental property . corner lot are moving really fast , most buy and knockdown to build skinny house / multi units .

|

10-05-2022, 03:23 PM

|

|

|

|

Join Date: Feb 2015

Location: Millet

Posts: 895

|

|

Quote:

Originally Posted by Trochu

For fun....

$400,000 mortgage, 25 year amortization, monthly payment at 3%: $1,892.98

$400,000 mortgage, 25 year amortization, monthly payment at 6%: $2,559.23

$400,000 mortgage, 25 year amortization, monthly payment at 10%: $3,577.95

Difference: $666.25/month to $1,018.72 for a total spread of: $1,684.97.

If it goes to 6%, it will be uncomfortable for alot of people, but I doubt people are loosing their homes. Pull the kids out of minor hockey, maybe a few other things, and you've pretty much made up the difference. If it goes to 10% though, and people are now expected to come up with an additional $1,687.97/month, I expect people will loose their homes/market will be flooded as they try to recover some equity before the banks take them.

|

And many mortgages will allow you to skip one or two payments a year. That's all that will happen for many people. Very few people will just walk away and lose.

|

10-05-2022, 03:48 PM

|

|

|

|

Join Date: Apr 2009

Posts: 257

|

|

Quote:

Originally Posted by fishtank

Depending on location. in Edmonton I have seen more for sale sign and for rent sign on rental property . corner lot are moving really fast , most buy and knockdown to build skinny house / multi units .

|

All 3 are in Lethbridge.

|

10-05-2022, 03:59 PM

|

|

Banned

|

|

Join Date: May 2021

Posts: 358

|

|

Quote:

Originally Posted by hogie

And many mortgages will allow you to skip one or two payments a year. That's all that will happen for many people. Very few people will just walk away and lose.

|

One or 2 Payments a year won't help if you get dinged an extra 600 a month. It is just delaying the inevitable

|

10-05-2022, 04:00 PM

|

|

|

|

Join Date: Dec 2008

Location: At the lake

Posts: 2,614

|

|

Quote:

Originally Posted by leeaspell

What will happen to renters in a situation like that? I assume rents will also increase to levels that most renters can't afford, or the owners will foreclose and kick them out.

Sent from my SM-G781W using Tapatalk

|

Rents will only go so high before they become unrentable for most. Unlike Alberta, in BC the max rental increase for 2023 is only 2%, which will leave a lot of landlords in serious trouble if they made the mistake of not locking in during the last few years of record low rates.

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

All times are GMT -6. The time now is 01:46 AM.

|